Table Of Content

Please be careful when using frequent flyer miles to calculate your trip cost. Travel insurance typically covers the cash value of non-refundable travel expenses. In other words, money you can’t get back from your airline or other travel provider. Frequent flyer miles are not covered as it’s difficult to determine their cash value. Travel Guard has a variety of options to help protect your trip depending on the coverage you need. For shorter cruises, the Preferred Plan may have all the coverage you need.

How Much Does Cruise Insurance Cost?

If you have questions about your specific nationality, please look at the Bulgarian MFA page. – A raincoat and layers, as Sofia’s weather can be unpredictable and showers are frequent. We recommend this Marmot PreCip jacket (here’s a women’s jacket and a men’s) as they are fully waterproof, lightweight, and stand up to the abuses of heavy travel.

AIG Multinational Insurance Fundamentals

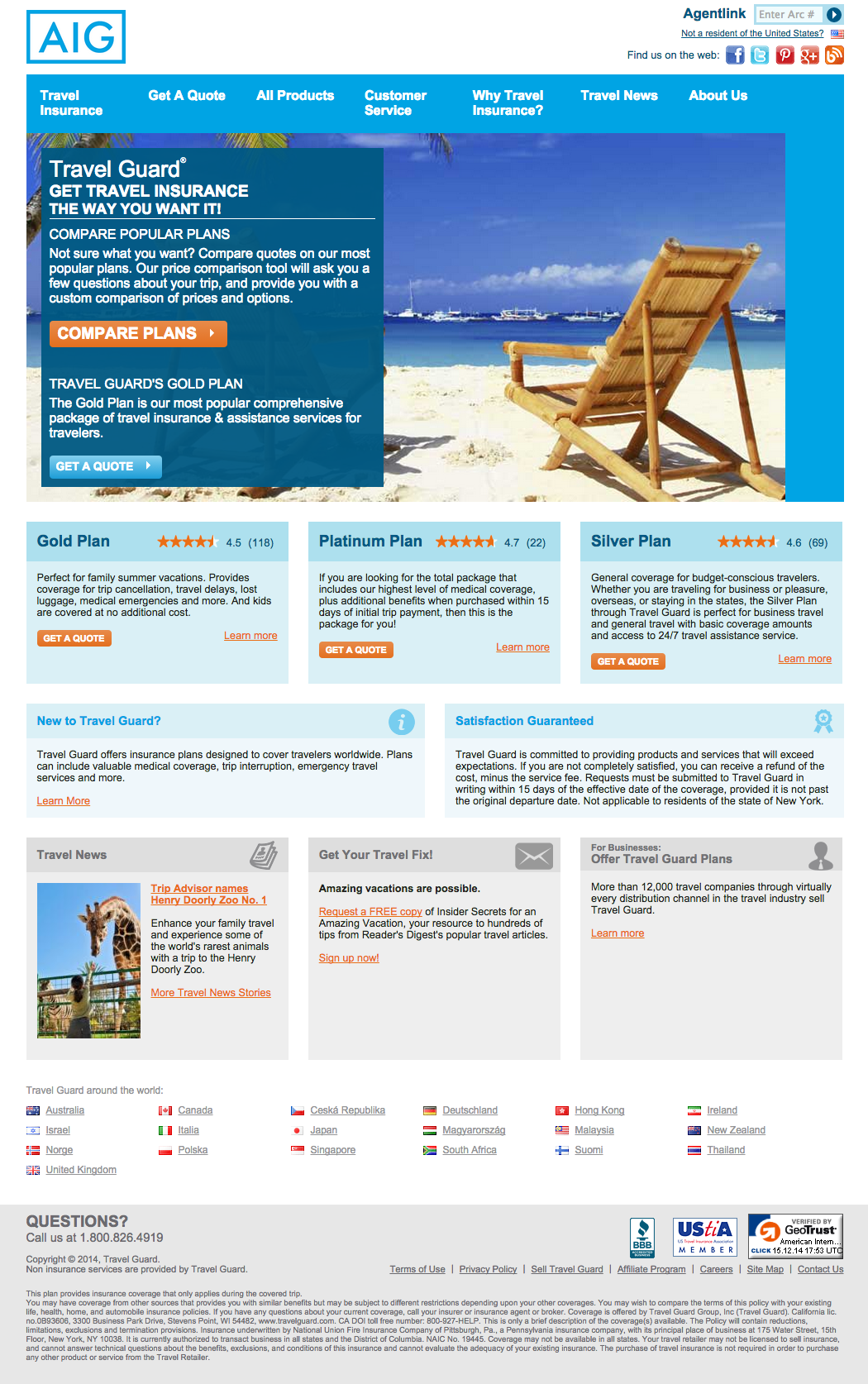

Some types of insurance, such as a standalone medical policy, cost just a few dollars a day. And even full-featured travel insurance policies can be cost-effective when you consider the benefits. He says this year, travelers are purchasing travel insurance on average within 11 days of their trip deposit to receive the additional benefit of the waiver exclusion for pre-existing conditions. In addition to these three primary plans, Travel Guard offers the Pack N' Go policy along with an Annual plan. This policy is for last-minute travelers who don't need trip cancellation coverage. Also, keep in mind that coverage offered on your credit card is generally secondary versus a primary travel insurance policy.

days in Iceland: The Best Winter in Iceland Itinerary

More importantly, it prevents you from losing money due to unforeseen circumstances and travel emergencies, and insurance fees are typically just a small percentage of your vacation expenditure. Flight delays caused by weather or a mechanical problem can keep us from arriving to our embarkation port in time. Plus, a host of other general issues can scuttle a vacation, such as the illness or death of a family member, cancellation of plans by a travel companion, job loss, airline delays and lost baggage. Travel Guard offers Cancel For Any Reason coverage as an optional add-on with the Platinum All Inclusive Package. If you are prevented from taking your trip for any reason not otherwise covered by the trip plan, Travel Guard will reimburse you for up to 75% of your prepaid, forfeited and non-refundable payments or deposits. Only a few travel insurance companies currently offer “interruption for any reason” coverage, such as Nationwide, Seven Corners, Travel Insured International and WorldTrips.

Coverage for Pre-existing Medical Conditions

And if you’re worried about having to cancel, the Cancel For Any Reason upgrade gives peace of mind. The mail-in claims process is clunky, and the upgrades aren’t available for all plans. Still, Travel Guard offers comprehensive coverage for a competitive price. With a range of benefit limits and optional add-on coverages, you can create the right plan for you. All Travel Guard travel insurance plans come with access to our specialized 24/7 emergency travel assistance support team.

Best for cancel for any reason coverage

5 Best Cruise Insurance Plans in April 2024 - NerdWallet

5 Best Cruise Insurance Plans in April 2024.

Posted: Fri, 29 Mar 2024 07:00:00 GMT [source]

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan. Our editors are committed to bringing you unbiased ratings and information. We use data-driven methodologies to evaluate insurance companies, so all companies are measured equally. You can read more about our editorial guidelines and the methodology for the ratings below.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately. This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip.

Extreme weather and hurricanes are typically not covered if the cruise commences as scheduled, though you might be eligible for trip interruption coverage if weather cancels the cruise or cuts the itinerary short. There are also insurance plans that offer trip reimbursement if a destination on your itinerary is under a National Oceanic and Atmospheric Administration-issued hurricane alert or warning. Pre-existing conditions are covered if you purchase coverage within 20 days of making your initial trip deposit.

Location & Hours

We’ve covered thousands of travelers’ vacations, business trips and travel adventures worldwide. A lot of the travelers we’ve helped love telling us their stories and sharing reviews. See how AIG Travel Guard stacks up against the competition and find the right travel insurance policy for you. While great coverage is important, it's also crucial that an insurance company has a smooth claims process, which Travel Guard lacks, according to its customer reviews.

With Travel Guard, you’re prepared if you need to cancel for work, illness, weather or any other covered reason. Each of these plans also include coverage for one child under 17 as long as their travel costs are equal to or under the adult's cost. Additionally, Travel Guard's Premium and Deluxe plans offer coverage that many of its competitors don't, such as its travel inconvenience coverage and ancillary evacuation coverage. AIG Travel Guard is a highly-rated established travel insurance company. AIG Travel Guard’s Preferred plan, which prices out at around $200, aligns with the John Hancock Bronze policy above. Add in CFAR coverage, however, and the comparison costs are closer to AIG Travel Guard’s $254 premium for its Preferred level plan that also includes CFAR.

Cruise insurance may cover missed connections, but it's important to read your policy before you purchase it. Each policy has different limits on how much you'll be reimbursed and what exactly you'll be reimbursed for. Travel insurance typically covers cruises and other types of travel, whereas cruise insurance is designed to specifically protect you while cruising or getting to your cruise. No coverage for pre-existing conditions that fall within this policy's 60-day look-back period. Nationwide's standard Universal Cruise Plan will be more than sufficient for many cruisers.

Once your local weatherman announces that a hurricane is howling along the path of your cruise itinerary, it's too late for you to buy travel insurance and be covered for any travel cancellations or delays caused by the storm. You'd only be covered if you had purchased the insurance prior to the naming of the tropical storm. Always comparison shop, looking at what amounts of coverage you get for what price. Medical benefits on policies you purchase after an outbreak becomes a "known event" may be severely limited. During existing outbreaks, you should research policy choices carefully before purchasing, as some will still provide medical coverage for travelers who become ill with the disease in question, while others will not. AIG offers policies with an option to name your own family member whose illness would count as a reason for cancelling a trip.

There’s so much history to explore with 2 days in Sofia including learning about the Ottoman Empire. We’ll show you the best things to do in Sofia, how to get around, where to stay and the best restaurants. We also have articles for popular day trips from Sofia like Plovdiv, the Rila Lakes, Buzludzha. If you plan to visit Sofia as a digital nomad as many travelers do, there are a lot of great coworking spots that cater to the digital nomad crowd.

This plan is perfect for business travel and domestic travel with basic coverages and benefit limits. The Travel Guard Deluxe plan is our best travel insurance plan with the most coverages, global travel assistance and access to 24/7 emergency travel assistance services. Take a look at our most popular plans below and customize the option that best fits your needs, or compare our plans side-by-side. Travel Guard’s Deluxe Plan includes our highest benefit limits for our offered coverages. Traveling seniors may find travel medical expense and emergency evacuation coverage to be the most reassuring when taking a cruise. This enhanced platform has a full suite of tools designed to help our travel advisors and other Travel Guard partners quote and offer travel insurance plans to clients.

No comments:

Post a Comment